We once discussed the inheritance yahoo format which we tagged powerful but i can tell you it’s nothing compared to what investment update brings to the table. The reason is because this update comes in different methods unlike inheritance work which has been the same for decades.

Incase you’ve been hearing people talk about investment format for client but don’t know how to get started, i believe this article will be of help. In addition, you will also learn how to avoid falling for fake investment schemes but before we continue, let’s see some of the different investment formats used by hustlers.

Different types of Yahoo investment format for client

There are different types of investment format. Let’s briefly discuss each one for a better understanding. This article may be too lengthy but that’s what it requires to cover the complete detail and description so stay connected till the end.

The Ponzi Scheme Format

Before we discuss how to utilize this as a yahoo boy, let me give you the full picture in summary how it works.

Ponzi schemes are everywhere. They might come with different names, apps, or websites, but the trick is always the same: they promise quick money, and in the end, most people lose everything.

Here’s how they usually work. Someone approaches you with an exciting offer “Put in this amount today and in just two weeks, you’ll get back double.” Sounds tempting, right? To make it more convincing, they show you screenshots of people getting paid or even send you a small payout if you try with a tiny amount.

That’s how they hook you. Once you see “proof,” it feels safe to put in more.

But the truth is, the money they pay you isn’t coming from any real business. It’s simply taken from the next person who joins. That’s why they’re always pushing you to invite your friends, family, or colleagues. The system survives only as long as new money is flowing in.

At first, it may look like everything is working. People around you are excited, sharing testimonies, and encouraging you not to miss out.

Then, one day, the story changes. Withdrawals start taking longer. You’re told the system is “upgrading” or there’s a “bank issue.” Those delays are just buying time because the pool of new investors is running out.

Eventually, the whole thing collapses. The website disappears, WhatsApp groups vanish, and the operators are nowhere to be found.

A few early participants may walk away smiling, but the majority end up in tears. That’s the cycle it always ends the same way.

The danger of Ponzi schemes isn’t just the money lost. They break trust. People feel ashamed, friendships get ruined, and entire communities suffer. The scammers know this, and they rely on our hopes, our desperation, and sometimes our greed to keep the trap going.

So here’s the bottom line: if an “investment” guarantees high returns in a short time, with little or no risk, it’s almost certainly a Ponzi scheme. Real investments don’t work that way.

Before putting your money anywhere, ask tough questions, do your research, and remember if it sounds too good to be true, it probably is.

So as a hustler, How do you get started with this update? Am sure that’s the question in mind right?

Well, this update is lengthy but like you already know, our briefing can become a heads up.

Fake Crypto / Forex Trading Format

Listen up, beginners. If you want to succeed in this game, you have to understand you’re not stealing instead, you’re selling dreams and until you see it this way, you might end up begging clients for money.

People already want to believe in quick money. Your job is to package that belief in a way they can’t resist.

Position Yourself as the Expert

Don’t ever show up looking desperate. Come as the “professional trader” who knows the markets. Speak with confidence.

Use big terms like leverage, pips, blockchain, bear market, liquidity. You don’t even need to know what they mean victims don’t either. They just need to believe you’re smarter than them.

The hook is simple: promise fast profits with little or no risk. That’s all they want to hear.

Build the Illusion

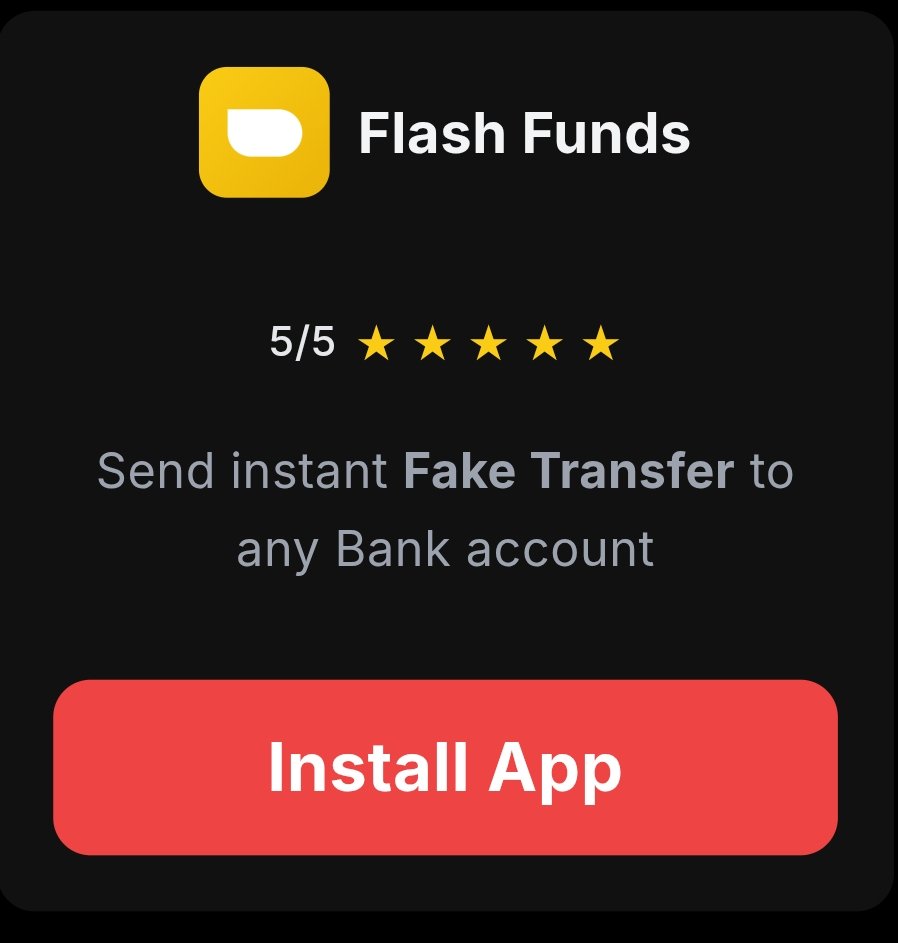

You can’t just talk, you need proof. Direct them to a website or app that looks professional. The trick is the dashboard make their balance “grow” every day. Numbers ticking up, fake charts moving, profits rolling in.

They’ll feel like geniuses for trusting you. They’ll think: “I’m finally making money from forex/crypto!” But remember: the whole system is smoke and mirrors. Nothing is real except the money they put in.

Making such website/apps might be quite expensive for beginners but it’s really necessary. You can contact any developer or reach out to us for affordability.

The First Deposit

Never push for big money upfront. Start small $100, maybe $500. If they test you with that, reward them. Let them withdraw it back with some “profit” on top.

That means you need some real funds if this update must be very effective. That’s why so many hustler avoid venturing thereby creating more room for success.

That first win is your golden bait. They’ll say to themselves: “If it worked with a small amount, imagine what I could make with more.” That’s the exact thought you want in their head.

Reel Them

Once they’re confident, they’ll drop bigger amounts $10K, $50k, even $100K. This is when the game shifts. Don’t let them pull out easily anymore. Throw in delays, excuses, and conditions:

- “The system is being upgraded.”

- “Your account needs verification.”

- “There’s a small tax/processing fee before funds can be released.”

Some will even pay those extra charges because they’re desperate to access their “profits.” That’s free money in your pocket.

Unregistered Online Investment Platforms

I’ve reviewed lots of real cases and regulator warnings (SEC Nigeria, EFCC, etc.). Below is a friendly breakdown of how these fake investment platforms work, the tricks they use, and exactly what to do if you or someone you know gets caught up in one.

What it looks like at first

On first glance the site looks real. Slick landing pages. Glossy pictures of farms, solar farms, oil rigs or condos. Big promises like “12% monthly” or “15% yearly guaranteed.

They use business words escrow, trustee, auditor, JV partner to sound official. They’ll show charts, “press mentions,” and testimonials so you think it’s professional and popular.

All of that is designed to make you stop asking questions and start imagining the profits.

How people are drawn in

Scammers use a funnel that mimics honest marketing: a targeted ad, a shared post, an email, or a WhatsApp forward brings you to a tidy website or an active Telegram/WhatsApp group.

They offer a tiny starter product or a short trial that promises a small, assured return. After you see a small payout (often staged or paid from other people’s money), they ask you to upgrade or lock in a bigger plan.

That first small win is the turning point it lowers your guard and makes you think “what if I invested more?”

The “proof” you see is fake

The dashboards, growing balances, and pending payouts are usually showpieces. Numbers can be fabricated. Sometimes the platform does a tiny, real withdrawal to make it convincing, but that’s controlled and limited.

Testimonials, screenshots, and influencer posts are often manufactured or paid for. Honest verification like audited financials or independent trustees is usually missing.

Where your money actually goes (high-level view)

When you deposit, your money often ends up in accounts controlled by the operators or through intermediaries (money “mules”).

If crypto is involved, funds can be swapped and mixed to hide trails. New deposits are used to pay small returns to earlier “investors” classic Ponzi behavior.

Real, large-scale investment into farms, rigs, or projects is rare; most of the cash is recycled, skimmed by insiders, or taken out of the system.

As soon as people start asking for withdrawals, excuses appear: “system upgrades,”KYC checks“compliance holds,” or requests for “tax clearance” or escrow fees.

They might ask you to transfer funds to a “release account” or tempt you with a new, higher yield package to roll over your money instead of withdrawing. Each delay wears down your resistance and can extract more cash.

How operators hide and disappear

Operators avoid being easy to track. They may use shell company names, offshore hosting, throwaway phone numbers, and many bank accounts or crypto wallets.

When the scheme starts collapsing, they shut down websites, delete social groups, and vanish. If crypto was used, funds may be mixed across wallets, making recovery very hard.

The psychology behind the scam (why it works)

- This isn’t just tech it’s human behavior:

- legal-sounding language and “auditors” create trust.

- Limited slots” pressure you to act fast.

- Seeing others (or influencers) post “proof” normalizes it.

- A small win makes you more likely to invest more.

- Victims often stay quiet, which lets scammers relaunch under a new name.

Red flags what to check before you give money

- If any of these are true, be extremely cautious:

- Guaranteed high returns with little or no risk.

- No regulator licence or no verifiable registration (in Nigeria, check SEC).

- No audited reports, no independent escrow or trustee.

- Pressure to recruit others or referral bonuses.

- Extra “taxes” or “fees” to release your withdrawal.

- Professional website but no verifiable leadership or real contact details.

If you’ve already deposited some money as a victim what to do right now?

Gather evidence: screenshots, receipts, chat logs, transaction IDs, web pages then Contact your bank or payment provider immediately ask about chargebacks or recalls.

If that doesn’t work, Report to authorities: EFCC, SEC (or your country’s cybercrime unit / securities regulator).

Additionally, Warn anyone you referred so they can stop too and finally, Consider legal advice for large losses recovery is difficult but not always impossible.

If someone promises big, guaranteed returns with little or no risk and you cannot independently verify where the money is held or how profits are generated treat it as a scam.

A pretty website or a convincing ad is not proof. Real investments are transparent, regulated, and clearly explain the risks

Romance Investment format

When you hear the word scam, you probably think of some stranger asking for money out of the blue. But some of the most dangerous scams don’t start with money at all they start with love.

Romance + investment scams are especially cruel because they play on two things people value most: affection and security. Victims don’t just lose cash; they lose trust, and sometimes even the belief that love is real.

Why I’m Writing This (Experience)

Over time, I’ve spoken with people who fell into this exact trap. Some were lonely and just wanted companionship. Others were smart professionals who thought they were making a safe financial choice. Different backgrounds, same heartbreak.

That’s why I decided to write this — not to scare you, but to help you spot the patterns before they ever reach your doorstep.

How It Usually Starts (The Hook)

It often begins with a harmless “hello.” Maybe on Facebook, Instagram, TikTok, WhatsApp, or a dating app. The person seems sweet, polite, and genuinely interested in you.

Soon they’re messaging every day. They check in every morning, ask how you slept, and share little details about their life. They may even send photos (often stolen) or find excuses to “video call” but always with poor quality or quick cut-offs.

It feels real. It feels like love. And that’s exactly what they want.

Where Money Sneaks In (The Switch)

Once they’ve built that bond, the topic of money slowly enters. Not in a pushy way at first. Maybe they say:

“I’ve been investing in crypto, it’s been so good. I want you to enjoy this too.”

“There’s this opportunity I can’t miss, but I need a little help joining. When it pays out, we’ll both benefit.”

“If we’re serious about our future, this is something we should do together.”

Notice how it’s never “give me money.” It’s framed as a partnership, as a way to build our future. And because the emotional connection is strong, people often don’t see the trap.

It’s not about being gullible. These scams work because they tap into human needs: What about Love and connection, everyone wants to feel special.

Talking about Financial security, everyone dreams of a safe future.

Put those two together, and you have the perfect storm. When someone you “love” says this investment is the way forward, it feels natural to trust them.

The Heartbreak Ending

At first, the scammer might even show you “profits” on a fake dashboard or pretend to return a small amount to build confidence. But once you send more, things change. Suddenly, your money is “stuck” and new fees are needed. If you hesitate, they guilt-trip you with lines like: “Don’t you trust me?” or “I thought you loved me.”

Eventually, they vanish deleting accounts, blocking numbers, and leaving you with empty hands and a broken heart.

Warning Signs You Shouldn’t Ignore

- They fall in love too quickly online.

- They avoid meeting in person or make constant excuses for video calls.

- They bring up investments or money after gaining your trust.

- They promise “guaranteed returns” or unusually high profits.

- They pressure you emotionally when you say no.

Be cautious with anyone online who mixes love with money, Double check investments with official regulators or trusted financial advisers.

Ask friends or family for their opinion an outside voice often spots red flags.

Trust your gut. If something feels off, it probably is.

If You’ve Already Been Scammed, First, please don’t blame yourself. These scams are carefully designed, and they fool intelligent, caring people every day.

What you can do:

- Stop sending more money immediately.

- Save all chats, receipts, and records.

- Report to your local cybercrime unit or consumer protection agency.

- Talk to someone you trust scams thrive in silence, but support helps healing.

And remember: losing money doesn’t mean losing your worth. What you gave was trust and kindness. That says more about your heart than about the scammer’s lies.

Final Thoughts

Romance investment scams are powerful because they mix two things that are deeply personal, emotions and finances. But the rule is simple. if someone you’ve never met starts blending love with money, take a step back.

Before you exit this page, you can also check my recent on FBI format for yahoo .

What i know is what i teach, and what I teach have many ways to benefit you if only you follow instructions carefully.