Green Dot is a popular prepaid debit card provider that millions of people rely on for everyday spending, online shopping, and managing their money.

These cards are convenient, easy to reload, and widely accepted making them a great option for many especially in the United States.

But like any financial tool, Green Dot cards can also be a target for scammers as fraudsters often take advantage of the card’s convenience and anonymity to trick people into giving away money or personal information without them knowing.

That’s why it’s so important to understand the different types of Green Dot scams, know the warning signs, and learn how to protect yourself if need arises.

By staying informed, you not only keep your money safe but also avoid falling victim to scams that could cost you more than just cash. This guide will walk you through everything you need to know about Green Dot fraud, from spotting scams to reporting them to the necessary department and safeguarding your account.

What is Green Dot Fraud?

Green Dot fraud happens when scammers target people using Green Dot prepaid debit cards. These cards are super convenient they can be used for shopping, online payments, and even managing money without a traditional bank account.

But that convenience also makes them a target for fraudsters. Scammers take advantage of the speed and sometimes anonymity of these cards to trick people out of their money.

According to the Federal Trade Commission (FTC), prepaid card scams are a common form of financial fraud in the U.S., highlighting the importance of vigilance

Understanding how these scams work is the first step to keeping your money safe.

How Fraudsters Exploit Green Dot Cards

Scammers love Green Dot cards because they allow money to move fast, often without leaving a clear trail.

A common tactic is to convince someone to buy a card and share the card number and PIN. Once they have that, the scammer can quickly empty the funds, and it’s usually too late for the victim to recover the money. The speed and ease of these transactions are what make Green Dot cards appealing to fraudsters.

Financial experts, including those at Green Dot Corporation, recommend never sharing card details with anyone you do not trust and always verifying requests independently.

Statistics and Trends in Green Dot Fraud

Green Dot fraud is not rare. Each year, thousands of consumers fall victim to scams, according to consumer protection agencies like the FTC and reports from NYC.gov on Green Dot scams. Common trends include:

- Fake emails or text messages that look like they’re from Green Dot.

- Scammers pretending to be government agencies, like the IRS, or utility companies.

- Online marketplace and remote job scams asking for payment via Green Dot cards.

By being aware of these tactics and trends, you’ll be better equipped to spot scams before they happen.

Common Types of Green Dot Scams You should be Aware of

Green Dot cards are convenient, but unfortunately, scammers know this and have developed a variety of ways to take advantage of users. Understanding the most common scams can help you spot red flags before it’s too late. Experts from the Federal Trade Commission (FTC) and Green Dot Corporation advise staying alert to these tactics:

Impersonation Scams

One of the most common schemes involves scammers pretending to be government officials, like the IRS, or utility companies. They often claim you owe money and threaten penalties or service disconnection unless you pay immediately using a Green Dot card. Always remember: legitimate agencies will never demand instant payment via prepaid cards.

Phishing Scams

Fraudsters send fake emails, texts, or social media messages claiming there’s a problem with your Green Dot account. These messages often include links to look-alike login pages designed to steal your personal information. Experts recommend never clicking on suspicious links and always logging in through the official Green Dot website.

Lottery and Prize Scams

Scammers may tell you that you’ve won a prize or lottery but require you to pay fees upfront via a Green Dot card to claim it. Legitimate lotteries and contests never ask for payment to collect winnings.

Romance and Online Dating Scams

Some fraudsters build online relationships to gain trust, then fabricate emergencies or travel needs, asking victims to send money via Green Dot cards. The FTC reports that these scams are especially common on dating apps and social media platforms.

Tax Refund Fraud

Criminals may use stolen Social Security numbers to file false tax returns, directing the refunds to Green Dot accounts opened in the victim’s name. If you receive an unexpected Green Dot card or notice suspicious tax activity, contact the IRS and Green Dot immediately.

Employment Scams

Fake job offers may ask you to pay upfront for equipment, training, or processing fees using Green Dot cards. Always research employers and never pay for a job opportunity.

Tech Support Scams

Fraudsters call claiming your computer has problems or viruses, then demand payment via Green Dot cards to “fix” the issue. Legitimate tech companies will not ask for prepaid card payments over the phone.

Online Marketplace Scams

Whether buying or selling online, scammers sometimes request payment via Green Dot cards, promising goods or services that never materialize. Using secure payment platforms and verified sellers can help avoid these scams.

Red Flags of Green Dot Scams

Being able to spot a scam before it happens is one of the best ways to protect yourself. Experts from the FTC and Green Dot recommend looking out for these common warning signs:

- Scammers often reach out unexpectedly, asking you to pay via a Green Dot card. Whether it’s a phone call, email, or text, legitimate organizations will not demand payment in this way.

- Fraudsters create a sense of urgency, claiming you must act immediately to avoid arrest, fines, or service disconnection. High pressure tactics are a classic red flag take a step back and verify the request before doing anything.

- No reputable company will ask for your Green Dot card number, PIN, or personal details over the phone or email. Sharing this information with strangers is almost always a scam.

- If someone promises a large prize, windfall, or job opportunity that requires you to pay with a Green Dot card, it’s almost certainly a scam. Remember: if it sounds too good to be true, it probably is.

- Check email addresses, phone numbers, and website URLs carefully. Scammers often use slightly altered versions of legitimate contact details to trick victims. Always verify by contacting the company directly through official channels.

How Green Dot Protects customers Against Fraud

Green Dot takes the safety of its customers very seriously. Over the years, the company has put several measures in place to prevent scams and protect user accounts. Experts in financial security and consumer protection often highlight these practices as examples of responsible prepaid card management.

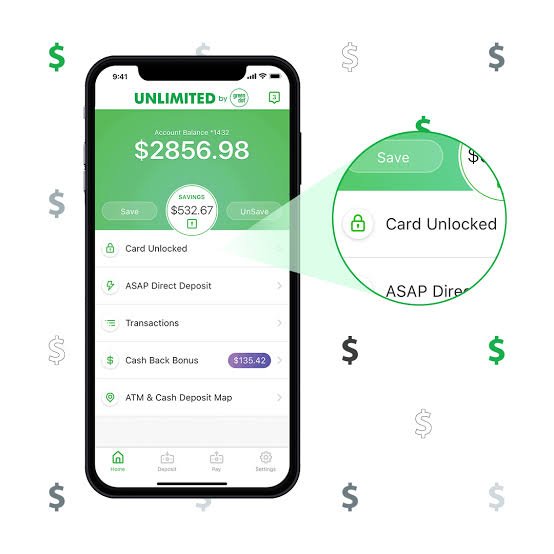

⬅️Green Dot uses sophisticated monitoring systems that track unusual account activity. These tools can flag suspicious transactions in real time, helping prevent fraud before it causes financial loss.

By combining automated alerts with expert oversight, Green Dot can respond quickly to potential threats.

⬅️To fight fraud effectively, Green Dot collaborates with banks, payment networks, and law enforcement agencies. These partnerships help identify scam patterns, recover stolen funds when possible, and bring scammers to justice.

By working with trusted authorities, Green Dot enhances the security of its services for all users.

⬅️One of the most important ways to prevent fraud is education. Green Dot provides resources, guides, and alerts to teach customers how to recognize scams and protect their accounts.

From warning about phishing emails to highlighting common fraud tactics, these initiatives empower users to make safer financial decisions.

How to Report Green Dot Fraud

If you suspect that you’ve been targeted by a scam or notice suspicious activity on your Green Dot account, acting quickly can help minimize losses. Following the guidance of experts at the FTC and Green Dot ensures your report is effective and properly documented.

Contact Green Dot’s Fraud Department

Report suspicious activity directly through Green Dot’s official channels. Their team is trained to investigate potential scams and help secure your account.

File a Police Report

Notify your local law enforcement. A police report creates an official record that may be helpful for investigations or disputes with financial institutions.

Notify the FTC and Other Relevant Authorities

The Federal Trade Commission collects information about scams and uses it to track fraud patterns nationwide. Depending on the scam type, you might also report to other agencies, such as the IRS for tax-related fraud.

Documenting Your Case

Keeping detailed records of communications and transactions is crucial. Save emails, texts, screenshots, and receipts related to the scam. Documenting the timeline of events can make investigations smoother and help authorities take appropriate action.

How to Protect Yourself from Green Dot Fraud

Protecting your Green Dot account is easier than you might think if you know what steps to take. Experts in financial security and consumer protection emphasize a combination of vigilance, education, and using built-in security features. Here’s how you can stay safe:

⬅️Never share your Green Dot card number, PIN, or login credentials with anyone. Scammers often pose as trusted organizations or even acquaintances to get this information. Treat your account details like a password for your bank they are private and valuable.

⬅️Stay alert for red flags such as unsolicited requests for payment, urgent threats, or “too good to be true” offers. Familiarize yourself with common scams, including impersonation, phishing, and lottery fraud, so you can spot suspicious activity before it becomes a problem.

⬅️Green Dot offers account alerts that notify you of transactions in real time. Turning these on and regularly reviewing your account statements helps you catch unauthorized activity quickly.

⬅️Fraudsters often target vulnerable populations, including the elderly. Sharing what you know about scams and how to avoid them helps protect those around you as well.

⬅️Take advantage of features like two-factor authentication, secure login, and password management tools offered by Green Dot. These tools add extra layers of protection to keep your money safe.

Questions you may ask

Does Green Dot refund stolen money?

Green Dot may refund stolen money if you report the fraud promptly and follow their claims process. Refunds are not guaranteed and depend on the circumstances of the theft. Always report suspicious activity immediately.

Why did I receive a Green Dot card in the mail?

You may receive a Green Dot card if someone opened an account in your name, if it’s a gift, or as part of a promotion. If you didn’t request it, treat it as potential fraud and contact Green Dot immediately.

What is the controversy with Green Dot?

In July 2024, the U.S. Federal Reserve fined Green Dot $44 million for “unfair and deceptive” practices. The violations included misleading marketing of financial products, improper blocking of legitimate customer accounts receiving unemployment benefits, and inadequate risk management policies.

Green Dot acknowledged these issues and committed to addressing them and cooperating with regulators .

Conclusion

Green Dot fraud can happen to anyone, but staying informed and vigilant makes a big difference. Watch for scams, protect your account details, use Green Dot’s security features, and report suspicious activity promptly.

With awareness, quick action, and the company’s fraud prevention measures, you can enjoy the convenience of Green Dot cards while keeping your money safe.

We focus on researching and publishing clear, reliable information about online activities. By explaining how different formats and tricks work, we aim to educate our audience and support safer internet use